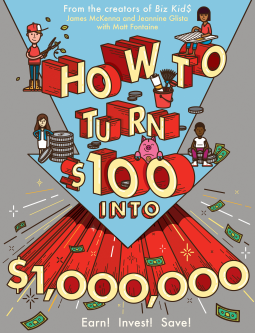

How to Turn $100 into $1,000,000

Earn! Invest! Save!

by James McKenna; Jeannine Glista; Matt Fontaine

This title was previously available on NetGalley and is now archived.

Send NetGalley books directly to your Kindle or Kindle app

1

To read on a Kindle or Kindle app, please add kindle@netgalley.com as an approved email address to receive files in your Amazon account. Click here for step-by-step instructions.

2

Also find your Kindle email address within your Amazon account, and enter it here.

Pub Date Apr 05 2016 | Archive Date Mar 28 2016

Workman Publishing Company | Workman Kids

Description

The ultimate kids’ guide to money: earning it, saving it, and investing it.

Hey, kids, want to become a millionaire? Or get a business off the ground? Or save up some money to buy a new bike? All it takes is understanding and putting into practice a few simple strategies and concepts about money:

Make it: Learn the ins and outs of scoring a first job, or even better, starting a business.

Save it: That’s right, millionaires are people who have a million dollars, not people who spend a million dollars.

Grow it: Invest and use the most powerful force in the financial universe––compound interest.

Next thing you know, you’re a bona fide financial whiz on the road to your first million. Now get going!

A thorough introduction to finance from the people behind BizKid$, How to Turn $100 into $1 Million includes chapters on setting financial goals, making a budget, getting a job, starting a business, and investing smartly – and how to think like a millionaire. Plus: a one-page business plan template, a two-page plan to become a millionaire, and a personal budget tracker.

“As you follow their plan, your interests will grow––and so will your money. Meanwhile, excuse me, I’ve got to reread a few sections.”––Bill Nye the Science Guy

Available Editions

| EDITION | Other Format |

| ISBN | 9780761180807 |

| PRICE | $12.95 (USD) |

Average rating from 15 members

Featured Reviews

What a great book this is. I’d say this book is ideal for everyone from precocious and driven ten year olds, to high school students, to those in their early twenties. I would even bet money that people over 30 would find something useful in this book, but it doesn’t recommend gambling so I can’t, heh.

It’s often exclaimed that we don’t teach kids about money and finances any more, and that they don’t learn any of those skills in school. This book goes over all of that and then some. It’s packaged as a “How to make $1,000,000” book, as that gets kids’s attention, but it’s basically all about setting goals, achieving them, and working hard for what you want. The book goes over everything from bank vs. credit union, to budgeting, to the stock market. There are even sections which humorously advise against stealing to make your money. Really great explanations of interest rates. And a handy glossary of finance terms.

It’s really good at getting the reader excited about making and saving money. I wish I had this book when I was just out of high school. And it’s all told in a very interesting way, even for those with short attention spans. Very short concise sections, lots of fun flow-charts, and several places where you fill out your own lists in order to figure out and achieve your goals. And it is very user-friendly. You don’t have to know anything about money to understand this book, even as it explains what compound interest is, or how to track your investments.

I’m putting my money where my reviewing mouth is, and I plan to get a copy both for my 23 year old daughter and my 25 year old son. They are at extremely different stages of their lives right now and this book should help teach them both how to prepare for life – a lot better than I taught them, because I didn’t even have all this information as they were growing up.

Quite a bit of thanks to NetGalley for allowing me to see an advance copy of this book for review. In return they’re going to sell at least three books, because who am I kidding, I need a copy of this book too.

Tonja D, Reviewer

Tonja D, Reviewer

The title alone catches the attention of young entrepreneurs or of the future want-to-be wealthy and dives straight into the topic from there.

This isn't a book for the youngest, but rather a good place for kids ages ten and up (more twelve and up) to start expanding their financial knowledge. It starts with a grabbing and humorous introduction which explains how good money management can be beneficial and offers an inspiring pep-talk which raises readers' excitement to a positive investing mood. From there, the book is divided into different chapters which cover everything from spending to saving, and working to investments. The bright graphs and tables sprinkled throughout the pages are easy to read and offer tidbits and notes along the sides, making the concepts clear and entertaining.

The information and explanations in this book are written at a level appropriate and understandable for the intended audience. It doesn't talk down but rather energetic and encouraging. The real life examples given to help support the money making theories not only include well-known personalities, but also true children and young adults who have managed to make even the littlest ideas fountain into a fortune. Tips are offered as to how the reader can use the information in this book and transfer it over into their daily life with realistic suggestions for the average teen. At the end of each chapter, the main points are summed up in a very brief and clear manner, which drives the thoughts home.

Meeting goals and increasing wealth is not something achieved over night and not an easy undertaking, and this book repeats this time and again. The suggestions offered cover basic saving, spending and work ideals, but don't offer a 'get rich quick scheme'. The later chapters offer tips on finding a job, resume writing and interview dos and don'ts (very, very basic) as well as tips on opening bank accounts and looking into future investments. These later chapters are more directed toward teenagers fourteen and above.

Summed up, this book offers a bundle of information on earning money, saving and investing in an entertaining and understandable way for kids ages ten and up. The tips are based on sound, basic and 'common sense' ideas, which all kids can use and will help steer them to a responsible handling of finances while give them insight as to how the entire job-savings-investment concept works. Especially younger teens who want to learn more about money management will find this book helpful and gain a better grasp on the terminology as well as different possibilities money management can entail.

Reviewer 274160

Reviewer 274160

I read this with my niece and nephews, as they are at that age where they need to start learning about money and saving. I think that it done the job. This book is adorable and I recommend it to any parent who wants to teach their kids how to be an successful adult.

Readers who liked this book also liked:

Jacque Aye; Hannah Templer; Megan Brown

Comics, Graphic Novels, Manga, Teens & YA

Jennifer Chiaverini

General Fiction (Adult), Parenting & Families, Women's Fiction

William Stixrud, PhD; Ned Johnson

Health, Mind & Body, Nonfiction (Adult), Parenting & Families