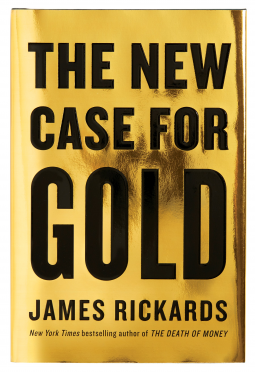

The New Case for Gold

by James Rickards

This title was previously available on NetGalley and is now archived.

Buy on Amazon

Buy on BN.com

Buy on Bookshop.org

*This page contains affiliate links, so we may earn a small commission when you make a purchase through links on our site at no additional cost to you.

Send NetGalley books directly to your Kindle or Kindle app

1

To read on a Kindle or Kindle app, please add kindle@netgalley.com as an approved email address to receive files in your Amazon account. Click here for step-by-step instructions.

2

Also find your Kindle email address within your Amazon account, and enter it here.

Pub Date Apr 05 2016 | Archive Date Jan 02 2018

PENGUIN GROUP Portfolio | Portfolio

Description

**USA Today bestseller and Wall Street Journal business bestseller**

They say John Maynard Keynes called gold a "barbarous relic."

They say there isn’t enough gold to support finance and commerce.

They say the gold supply can’t increase fast enough to support world growth.

They’re wrong.

In this bold manifesto, bestselling author and economic commentator James Rickards steps forward to defend gold—as both an irreplaceable store of wealth and a standard for currency.

Global political instability and market volatility are on the rise. Gold, always a prudent asset to own, has become the single most important wealth preservation tool for banks and individuals alike. Rickards draws on historical case studies, monetary theory, and personal experience as an investor to argue that:

• The next financial collapse will be exponentially bigger than the panic of 2008.

• The time will come, sooner rather than later, when there will be panic buying and only central banks, hedge funds, and other big players will be able to buy any gold at all.

• It’s not too late to prepare ourselves as a nation: there’s always enough gold for a gold standard if we specify a stable, nondeflationary price.

Providing clear instructions on how much gold to buy and where to store it, the short, provocative argument in this book will change the way you look at this “barbarous relic” forever.

They say John Maynard Keynes called gold a "barbarous relic."

They say there isn’t enough gold to support finance and commerce.

They say the gold supply can’t increase fast enough to support world growth.

They’re wrong.

In this bold manifesto, bestselling author and economic commentator James Rickards steps forward to defend gold—as both an irreplaceable store of wealth and a standard for currency.

Global political instability and market volatility are on the rise. Gold, always a prudent asset to own, has become the single most important wealth preservation tool for banks and individuals alike. Rickards draws on historical case studies, monetary theory, and personal experience as an investor to argue that:

• The next financial collapse will be exponentially bigger than the panic of 2008.

• The time will come, sooner rather than later, when there will be panic buying and only central banks, hedge funds, and other big players will be able to buy any gold at all.

• It’s not too late to prepare ourselves as a nation: there’s always enough gold for a gold standard if we specify a stable, nondeflationary price.

Providing clear instructions on how much gold to buy and where to store it, the short, provocative argument in this book will change the way you look at this “barbarous relic” forever.

Available Editions

| EDITION | Other Format |

| ISBN | 9781101980767 |

| PRICE | $26.00 (USD) |