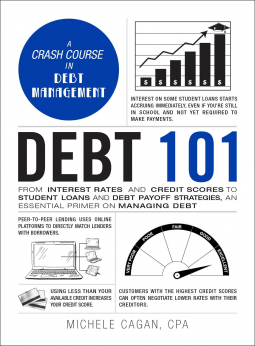

Debt 101

From Interest Rates and Credit Scores to Student Loans and Debt Payoff Strategies, an Essential Primer on Managing Debt

by Michele Cagan

This title was previously available on NetGalley and is now archived.

Send NetGalley books directly to your Kindle or Kindle app

1

To read on a Kindle or Kindle app, please add kindle@netgalley.com as an approved email address to receive files in your Amazon account. Click here for step-by-step instructions.

2

Also find your Kindle email address within your Amazon account, and enter it here.

Pub Date Feb 11 2020 | Archive Date Feb 11 2020

Description

The key to borrowing, managing, and paying off debt is understanding what it is, how it works and how it can affect your finances and your life. Debt 101 is the easy-to-follow guide to discovering how to pay off the debt you have plus learning how to use debt to your advantage.

Debt 101 allows you to take control of your money with strategies best suited for your personal financial situation—whether you are buying a home or paying off student loans. You will learn the ins and outs of borrowing in a simple, straightforward manner, managing student loans and credit card debt, improving your credit score, understanding interest rates, good debt vs. bad debt, and so much more. Finally, you can get ahead of the incoming bills and never let your debt intimidate you again!

Available Editions

| EDITION | Other Format |

| ISBN | 9781507212660 |

| PRICE | $16.99 (USD) |

| PAGES | 256 |

Featured Reviews

Reviewer 246080

Reviewer 246080

This is a very informative and helpful book that should be required reading for all young adults starting out

Wow! I did not expect a book titled Debt 101 to be this interesting and educational. But was I wrong. The book thoroughly explores the concept of Debt objectively and subjectively. It takes about all kind of debts be it payday loans or bank loans or the most common student loans. The thoroughness with which each type of loan is covered is awesome. One comes out almost 90% knowledgeable after reading this book and will be able to evaluate their loan options better. I highly recommend this book to anyone going especially someone who lacks basic knowledge of loans and debt. I particularly liked the chapter on Student loans. I wish this book had come out when I was taking loans out for my medical school. I probably would have saved bunch of money and made educated decisions rather than financial representative at the school tell me where to sign.

Overall, I highly highly recommend this book especially to students.

Marion J, Reviewer

Marion J, Reviewer

This is a great resource for helping to manage debt. It provides tons of information that is easy to understand. It is not necessary to read straight thru to find information. Instead, the author makes it easy for you to jump around to specific areas to find information that you are most interested in. And you don’t have to have a business degree to understand it. This would make a great gift for a teenager or a graduate, whether high school or college, to provide them with an overall understanding of what debt is and how to manage it. Thank you to NetGalley, the author and publisher for the opportunity to review this book.

Readers who liked this book also liked:

L.M. Montgomery, Crystal S. Chan, Kuma Chan

Children's Fiction, Comics, Graphic Novels, Manga, Teens & YA